An App to Build a Debt Snowball

Getting a raise, a promotion or a better job will all seem minor if you’re buried in debt. But once you get out of major debt, you’ll see things in a whole new light. Suddenly, the money you’d normally put toward a credit card bill or help pay off a student loan or a car loan is your to do with what you want.

A new app called Pay Off Debt helps accomplish this new insight by using the debt snowball method to pay down debts.

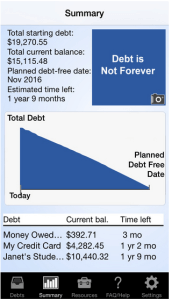

The app encourages users to pay off debt by showing them that no matter how big their debt is, they can tackle it and eliminate it over time.

What’s a debt snowball?

A debt snowball works like this: You make the minimum payment to all debts except one — usually the one with the lowest balance. You then pay the minimum payment plus as much extra payment as you can to one debt. This process is repeated until all of your debts are paid in full.

Debts can be paid with the debt snowball method in any way you choose, but the most insightful way is to pay off the lowest balances first, even if they have the highest interest rate. You’ll see immediate results with the app and will continue to be motivated to pay off more debt, even though it makes more sense to pay off the highest interest rate debts first.

Instead of spreading out any extra payments to all of your creditors, such as $20 more to five credit card bills, you make an extra $100 payment on the lowest bill so that it will be gone quicker. It’s a debt snowball in action.

As credit cards are paid off, that gives you more money each month to pay off another credit card, until they’re all paid off.

Pay Off Debt app features

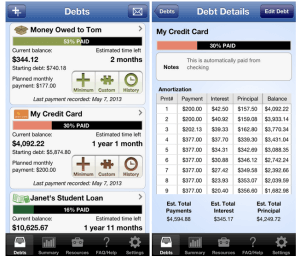

Progress bars show how the entire debt snowball is moving, such as with an estimated time left to pay off each individual debt.

The payment history for each debt is recorded, and payments are easy to record and change.

You can also turn off the snowball to see how long it would take to pay off all of the debts if you weren’t using the debt snowball method.

What does Add Vodka get out of this? If you buy the $5 Pay Off Debt app with our affiliate link, we get a 30 percent cut. It’s a win-win. You get a great app to help you use a debt snowball, and we get some cash to help us afford to continue writing here.

Let us know what you think of the app in the Comments section.

I think it’s great that the app shows users that their debt can be tackled no matter how big it is. A few people around me never got to really sticking to their debt payment schedules because they said the figures were too daunting. I think this app might be able to serve as the visual reassurance they might need!

I agree. I think if it’s something you can see every day, it can make it less daunting and easier to tackle.