Financial Wins and Spending

Any long term readers of my blog will know that I don’t typically post spending reviews, weekly or otherwise. I did back in 2010 and 2011, but my paranoid nature took over and I slowly phased them out.

This week is different, however, because of my newfound commitment to the budget after our wedding. We have been trying to detox from the excessive spending surrounding our nuptials. You can read more about it at my Post Wedding Detox post, but essentially I am committed to spending less and saving more.

Getting married is a harrowing experience on your budget.

To stay on track, I have been tracking my spending, but to keep me accountable I thought I’d post it here.

If I leave my spending review to the end of the month, I find that I fall off the wagon. I’m too short sighted, which is something I have to work on. I tell you, for the amount of time I spend thinking about and planning for the future, I have a damn hard time living my goals in the short term.

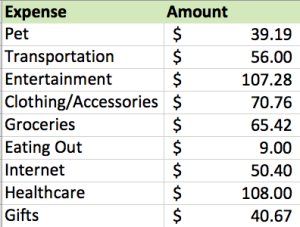

Here is a little spreadsheet of what I spent in the past week (not including today, which will go on next week’s review):

Entertainment

This number reflects the entertainment costs for both J and myself. It is a bit of an exception as we went to a comedy club to celebrate one of my best friend’s birthdays and then out for drinks after. J and I bought a round for her birthday and also to thank her and her boyfriend for their help with the wedding.

Clothing/Accessories

I don’t think I’ve mentioned where we are going for our honeymoon on the blog, but this $70+ expense is related to the honeymoon. We are trekking, and I don’t have hiking boots, so I had to buy some.

We had a $100 gift card to Mountain Equipment Co-Op, which is where I bought my boots. This bill also includes some water purification tablets.

Groceries

J also bought about $75 worth of groceries, but I am not including any money he spent in this review so I will leave those out. We have been trying to use what is in the cupboards recently, so that has kept the grocery bill fairly low. Most of this cost was fresh produce. I scored at a local farmer’s market with a 5 pound bag of local carrots for $1.99.

Healthcare

My new job doesn’t provide benefits because it’s temporary, so at the end of July I made appointments at the dentist to get everything done that needed to be, so that I didn’t have to pay out of pocket for them come August.

Most of the work done was covered by my previous job’s benefits, but I had a balance of $108 to pay.

Gifts

It was my sort-of niece’s third birthday party last Saturday, so I got her some books and a bathing suit.

Side note: is anyone else horrified by how early kids are stuffed into gender roles? Shopping for her gift was not easy because I’m fundamentally opposed to the Disney Princess crap and all of the toys for three year olds were stupidly gender specific.

Overall, I didn’t have a terrible week since I definitely made far more than I spent. The clothing and entertainment categories are exceptional. It’s not every weekend that a good friend has a birthday!

Financial Wins

I’ve had my fair share of good financial luck this week, and I’m feeling particularly positive lately, so I thought this would be a nice opportunity to count my money blessings.

$25 Over Limit Fee Reversal

I posted this on Twitter a couple of days ago:

I made a payment to a vendor for a wedding service, and then transferred the money from my bank account to my card to cover it. Unfortunately the previous payment didn’t get to my card before the expense, so it pushed me over my already low credit limit, incurring the fee that you see in the Tweet above.

One phone call to the credit card company and it was reversed.

$110 From Craigslist Sales

We finally sold a sink that we had sitting around. Don’t ask why we had a sink, but it was brand new and we have had it for years. We sold it for $70. We also sold two drink dispensers from the wedding at a profit. We bought them on sale for $15 each, and sold them for $20. I didn’t even realize we sold them for more than we bought them for until a day later.

Price Adjustments

We got a ton of gift cards for the Hudson’s Bay Company as wedding gifts, so we recently used a few on some kitchen items that we didn’t get from our registry.

A couple of days later, I checked our registry, and realized that those things went on sale.

We took our receipt in and got a price adjustment of about $70 for all of the items. Score!

Cheques Coming In

Apparently we’re just the luckiest people alive. We deposited the $2600+ from the government that we got back for J’s taxes paid, and I also got paid for my first three days of work at the new job. It was definitely nothing to cough at. I love me a good raise.

Free Product

I used my Swagbucks [Referral Link] on a $100 Amazon Gift Card, and spent the gift card on a new makeup brush and some powder that I had run out of. I would have had to buy both of those things at Sephora had I not had Swagbucks to spend, so that’s a huge money bonus for me.

Check out my Swagbucks review to get free stuff.

Financial Bummers

In an effort to not bury my head in the sand, I figured I better include the negative financial things that happened throughout the week, but I can definitely say that this week there were none.

J and I had a really lucky week financially and we are very fortunate.

Did you have any financial wins this week?

I also felt the need to avoid spending money after the wedding! Yikes that was a lot of money all at once!

Also, like you, I bought new hiking boots for our honeymoon. We didn’t do as much hiking as I thought we would, but I think we did just the right amount (so we didn’t get completely worn out hiking all the time!)

We’re going on a full blown 10 day trek, so I guess we need the boots, but I think they are great to have regardless.

What a great list of wins! And, YES, I have a one year old daughter and I’m not a big fan or the princess, glitter, and glamour overload. Thankfully for the most part she inherits her older brother’s toys which are more gender neutral.

It’s exhausting, isn’t it? I know it’s impossible to protect children from gender roles and stereotypes completely, but it shouldn’t be THAT difficult at three!

Wow, sounds like a really awesome week! Nice work getting the refund from the Bay.

Regarding The gendered toys, isn’t it insane! Every time I go shopping for the cousin’s kids I end up in a fit of rage. I also my best to get non gendered toys or not not the stereotypical ones. Any three year old can have a Tonka truck in my books!

It also applies to little boys too. What if they want a cabbage patch doll and not a toy dinosaur? It’s all insane. Trucks, cooking play sets, books.. all fair game to me.

Glad to see you are posting your budget updates. I really do enjoy seeing them. I might tone mine down a bit but for now I’m happy with them. That was great you got the $25 back and a good point that sometimes a phone call is it all takes. Weddings do cost a fortune and even after the wedding the budgeting must go on. You have some nice funds coming in this month, well done.

Budget updates are helpful for me to stay on track, and I also like to get inspiration from other bloggers updates. Thank you for the kind words!