Trading gold online: an introduction

Gold is one of the most important precious metal in the world, and has been prized as a store of wealth for millennia. This yellow metal is mined from deep within the earth by companies including Barrick Gold, Newmont Mining, and Goldcorp. Gold is mostly found in countries like South Africa, Australia, China, Russia and the United States, among others.

There are several methods you can profit from gold, as a trader. First, you can buy physical gold and wait for its price to move up. Second, you can buy stocks of the companies that produce the gold. Third, you can buy an Exchange Trade Fund (ETF) that tracks the gold price. Finally, you can use online brokers such as easyMarkets to buy and short gold using a contract for difference (CFD).

A common question among new traders is the relevance of gold and why it is valuable to investors. They are right to ask this question, because unlike other commodities, gold does not have a major use. Of all the gold that is mined, only a small percentage of it is used for industrial purposes.

To understand why gold is a valuable metal, it is important to look at a historical perspective. In the past, gold was used as a currency and as an important metal. In the 18th and 19th century, countries pegged their local currencies to gold. During World War One, Germany and United Kingdom abandoned the gold standard because they didn’t have enough of it to fund the war.

After World War Two, the Bretton Woods agreement came into effect. In this system, many countries pegged their local currencies to gold. This changed in 1971, when Richard Nixon unpegged the US dollar to gold. This led to a sharp rally in gold, with its price rising from about $35 to more than $120 within a few months.

Today, gold is viewed by many traders firstly as a safe haven, in case of a recession or global uncertainty. However, this belief refuted by some experts who argue that gold price tends to fall during recessions. Second, traders view gold as a hedge against inflation. Others argue that gold is important because it would be a useful asset in case of an apocalypse or a major catastrophic event. But these theories are also argued against by some experts.

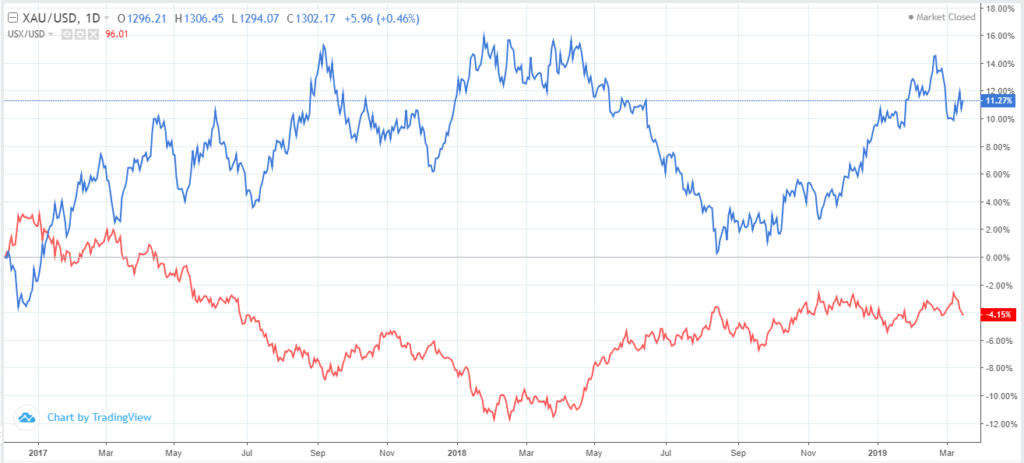

So with these differing viewpoints, how should you trade gold? A good way to trade gold is to compare it to USD. This is because gold is usually quoted in dollar terms. So when USD gains, gold often declines. And if USD falls, gold tends to decline. The chart below shows the movement of gold price vs the dollar index in the past five years. The dollar index compares the value of the USD with its major global peers such as Yen, Euro, and Sterling.

Therefore, you should look at gold in conjunction with USD. For example, if the Federal Reserve starts raising interest rates, the common implication is that the USD will strengthen. The same is true if there is a stream of positive economic data from the US. This will lead to a gain for USD and a decline for the gold.

For quantitative purposes, you can perform a correlation analysis for gold and the dollar index. To do this, you should take a specific period based on your trading style and download the data. Then, you should run a correlation analysis in Excel or a similar tool. If the correlation is close to minus 1, it will mean that the two are inversely correlated. With this data, you can then do an arbitrage or pairs trade.

Technical analysis too, can help you trade gold. By using the technical indicators such as moving averages, Relative Strength Index, MACD, and Stochastics, it is possible for you to trade gold. If you are a beginner, you should take time to learn how these indicators work. Then, you should apply them to gold charts in a practice account before moving to a real account.