Spring Cleaning For Your Finances

It’s not quite spring yet in the great white North, but it was 8 degrees (46.4 F) in my region today and sunny, so that counts for something.

Whenever it starts getting spring-like out, I get excited to start spring cleaning. I’m not sure why spring holds that trigger in my brain that other seasons lack, but when it’s sunny but still too cold for a t-shirt, my brain screams “organize, clean, dominate thy household!”.

Inevitably after a day of this madness I end up in a heap on my couch with a glass of wine, moaning how un-domestic I am and how nobody should have to live through such strife.

But I digress. Frankly, we haven’t been in our house for long enough to feel like it needs a good, deep clean, so I’ve been finding other things to spring clean, including my car and my finances.

Yup, my finances. I find that, over a year, I accumulate expenses. Not huge expenses, but $5 here, $2 there, $20 elsewhere. So I’ve tidily opened my budgeting spreadsheet, went through each line and decided:

- What expenses I could do without (trimming the fat)

- Where I needed to cut back (but not eliminate the item) (revisiting my diet)

- Which need more funding (upping my cardio)

- How my budget helps me work toward my 2013 master plan (building muscle)

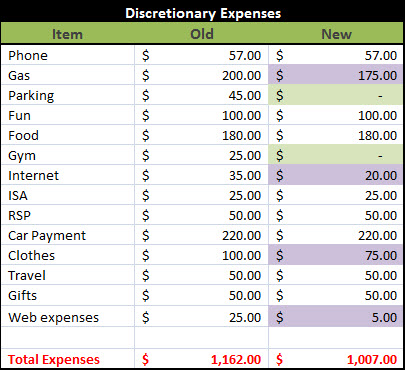

Trimming the Fat

If you are looking at your budget and seeing some items on there that you no longer use, get rid of them!

If you need a little motivation to kick the subscription to the curb, do some calculations. Add up how much that monthly expense costs you per year. Then, use a retirement calculator to see how much it would end up being in your retirement savings account in 25, 35, or 40 years (however long until you retire).

That should light the fire under you to trim back that expense.

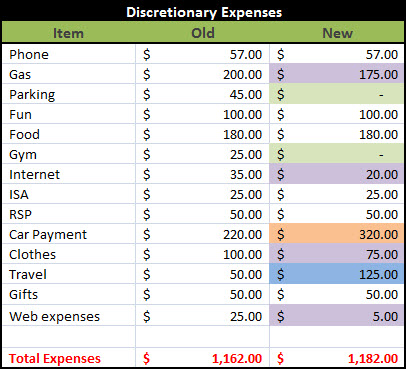

I eliminated the light green highlighted areas in my budget. Our house has some nice trails and parks around it, so I decided to give up my gym membership to work out more outdoors. I also cut my parking costs, because there is some free parking in a residential area close to my office building that I can use instead.

Revisiting My Financial Diet

While there are some items in my budget that I cannot (or won’t) remove completely, there was certainly some opportunity for reducing the expense.

If you don’t know where to start with this, ask yourself whether there is an opportunity to share an expense with somebody, or combine services. Can you carpool one day a week to save yourself some gas? Or bundle some services to reduce them?

Gas is purely luck; the drive from our new house to my workplace is shorter, so I had the opportunity to back $25 off of my budget.

I was able to approach my brother to share our wireless internet costs.

I bought a lot of clothing in 2012, and I don’t anticipate needing anything for quite some time, so I’ve cut back my clothing budget to $75/month ($900/year).

Finally, I was able to trim $20 from my website expenses so that I could re-route that cash elsewhere.

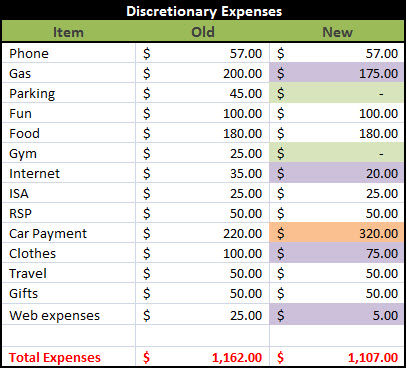

Upping My Financial Cardio

Some expenses need to go up, not down, for your financial health. To figure out which ones need this type of attention, I suggest looking at your spending. If you are repeatedly over spending in one area, you likely haven’t budgeted enough for it. Increase that line on your budget so that it’s more realistic.

Debt payoff can also always use more cash, so increase that as well.

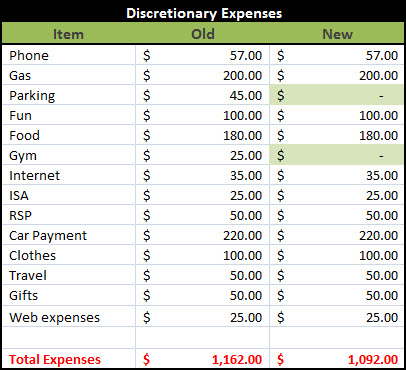

How My Budget Helps Me Work Toward My Goals

At the end of the day, we budget and track our spending (and really, care about our financial health in general) so that we can reach our goals.

Whether your goal is just simply to be rich, or to travel more, or put your child through college, that’s all we are doing here.

Write down your goals. Include short term, long term, and life goals. Go over your discretionary budget and decide HOW each item helps you achieve those goals. If they don’t, eliminate them!

Some may need more funding with your goals in mind. Like mine:

One goal of mine – highlighted in blue – needed more funding, because it is very important to me. I want to see a little more of the world, so I increased my travel budget by $75/month.

The items for phone, gifts and fun on my discretionary budget help with a life goal to be connected with family and friends, enjoy my life and be happy. Clothes and food are necessities, however, what is not is how much I spend on them.

My internet, ISA and RSP (as well as any transportation costs) help me reach my financial goals, and therefore are very important to me.

Spring cleaning your finances doesn’t have to be hard or take a long time. It doesn’t always mean saving a ton of money, either, but rather just re-evaluating priorities and doing something about the items that aren’t important.

We’ve just done the same thing this month. Dumped what we don’t need, or can live without and put more focus on clearing debt! Feeling quite motivated.

This is a great way of looking at your finances and finding ways to streamline them. We typically do this once or twice a year and it’s always nice to find ways you can cut down your expenses a bit and put it towards something else.

Cutting out a gym membership can save you some money like you said, and since the weather is warmer there than here, than working out outside is not a bad idea.

I recently joined a gym right around the corner and I must say I love the classes. It’s much too cold here to consider working out outside.

We need to spring clean our finances also. Thanks for the reminder!

I have started Spring cleaning my home and never thought of revisiting my budget to do the same. What a great idea! I am currently on a no-spend diet for the next 3 months, so I will have to revisit your ideas after I pay off all of my debt in April.

I love the idea of spring cleaning your finances. I try to take a look at things quarterly to see where my needs have changed. I think the clothing budget was a good cut!

I have to do a little financial spring cleaning soon. I think after a year, things can start to slip away from you. Great post Daisy!

I’d love to feel 8 degree weather! I’m under like 4inches of ice right now. Great post! Hubby and I just revised our budget a few weeks ago but we need to again when I start back to work. Good job and good luck paying that car off!

Spring cleaning finances is a great idea. We’ve been thinking about our budget a lot lately as well as we consider buying a condo. Makes you realize what is and isn’t important in your life.

Awesome idea! I’ve been going through this a bit in the last few months. So far, I’ve chopped down:

1) Cell phone bill by ~$50/month

2) Prepared my own taxes (saved $50/year over TurboTax or $200-500/year over using a CPA)

3) Lowered my Entertainment budget down from $250-300/month based on lowered spending over the last 6 months (savings: $100-150/month)

4) Lowered my Dining out budget down from $100/month to $70/month based on lowered spending

5) Lowered my work lunches budget from $200/month down to $100/month and then $80/month

Then again, there are some things that have increased, but at least I’ve lowered the ones that I can based on spending.

This is a great idea Daisy. We go through our finances several times a year looking for ways to trim the fat. I think we’ve gotten to the point now where we are not willing to trim any more out of the budget, but it is always good to be vigilant.

Love the comparison to fitness… when you are done with the finances, fancy joining me in the preparation to get ready for Tough Mudder?

What i found interesting about your post is A. I read it when I should also be cleaning and B. I have no life. For me to cut spending Id need to cut electric. Also a tip…eBay has cheap stuff thats where Ive been buying stuff my family needs. If you do have to get something i recomend looking Ive been able to cut my clothing budget in half that way.

Daisy – also being in Canada, it is *so* not Spring here! 🙂 But I like the idea of financial spring cleaning!

Good job on reassessing your finances and trimming the “fat”. It’s so easy to get complacent and slack off when it comes to budgeting… but you’re doing a great job to avoid that!

This is a great, step by step guide. I’m kind of in lock down mode with my budget right now. I review it monthly, but I’m not changing any priorities until I get my debt paid off. Once that’s gone, it’ll be time for some serious spring cleaning and decision making about whether to save for a house, travel, etc.