Post Wedding Budget Detox

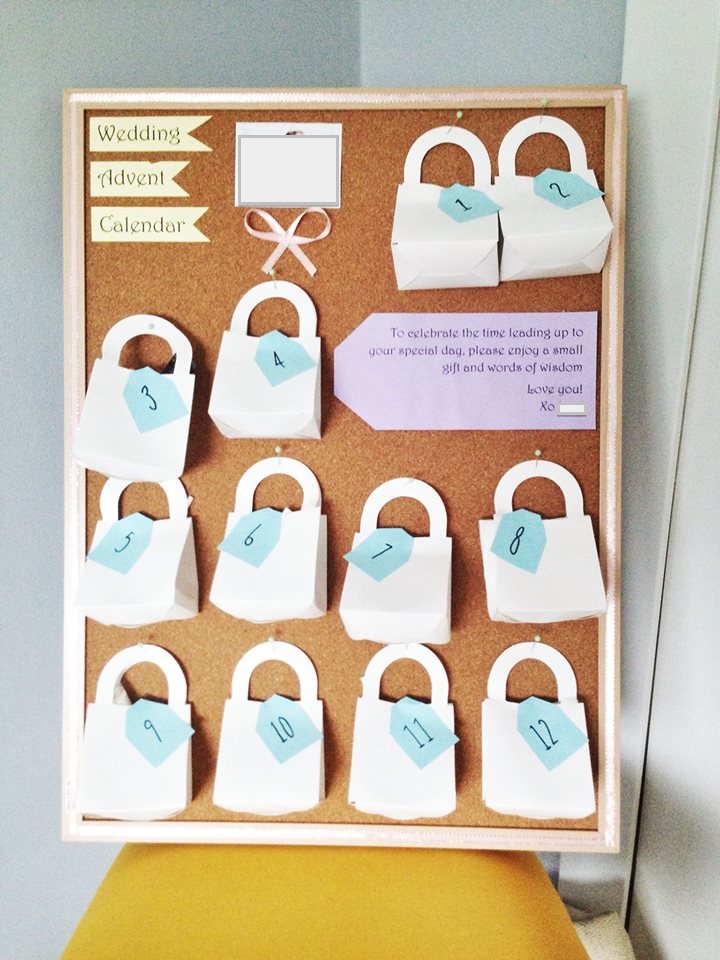

Hello everyone! I’m counting down the days to the wedding with this awesome advent calendar that my cousin made me for my bridal shower.

It’s so close, yet I am in complete and utter denial about how much there is still left to do. Instead of finding music on iTunes for the reception, or making tags for the wedding favours, I’m obsessing over my budget and our savings amounts.

I wanted to have a quiet, simple, small-but-big wedding, but since our engagement, we’ve been spending hundreds of dollars per month on the thing. If it’s not the marriage license ($100), it’s paper plates, forks, and napkins from the dollar store ($10) and gifts for the wedding party from Etsy ($200) and outfit alterations ($300) and flowers ($700).

It all adds up to an exorbitant amount.

Math doesn’t lie, and neither do credit card bills; so far, all in (including parking for events, thank you cards, a parking ticket that I got when I ran into a store to get wedding items), we are at $2,992.34. This sounds like a not-so-bad number, for a wedding including the gown and everything, but we haven’t paid the balance on the photography ($850) or the caterer ($1950), nor have we tipped the vendors or bought all of the gifts.

That number also does not take into account that my fiancé’s parents contributed $1000, my dad contributed $550, and my mom and her husband are paying for the venue and event rentals.

Now that is one expensive wedding! When it’s all said and done, we’ll have spent collectively about $11,000 on the wedding.

Now, I would be lying to myself and to you if I blamed all of my budgetary problems on the wedding. The truth is, I’ve been spending what I want, when I want, and it’s been really hurting my savings rate.

Over the past half of a year, I’ve spent money on entertaining, clothing, travel, my businesses, and eating out like it’s going out of style. It needs to stop.

Hosting a BBQ with 15 people and declining every time somebody asks what they can bring costs more than a week’s worth of groceries. Buying clothing items just because I like them when I am still in the process of losing weight has cost a pretty penny. Paying for parking 3x my normal amount has added up, as well.

I am not the queen of England, and I don’t need to be spending like this.

I need to go on a major budget detox.

Eating out needs to stop; when we entertain, we need to be taking people up on their offers to bring things. I don’t need any new clothes until I no longer fit in to 90% of my wardrobe. I don’t need makeup and beauty products from the drug store just because they catch my eye.

Starting now (except for the wedding stuff we still have to pay for), it’s budgetary detox time. No more coffees out, no more shopping, and no more restaurants.

I start my new job in two weeks, and we’ll have to see at that point what our commuting costs will be, and how much my take-home pay is. After that we’ll do a budgetary overhaul.

Ah, weddings. They get so expensive, so quickly! Have fun! That is a super-awesome advent calendar thing, I love it.

When we were nearing the end of our wedding planning, we went on a spending halt as well. It was nice to not see our accounts lose value every month because of one bill after another. We made it a point to live our frugal lives and start saving as much as we could once again.

Enjoy your big day! 🙂 $11k isn’t even that much on the wedding scale, so it’s great in that respect… But I know it’s a hard pill to swallow shelling out that money.

Congratulation on keeping the spending under $11,000 though! From what I hear, it’s easy to quickly climb well above that mark!

I totally feel you on this – with all the wedding spending, it’s really easy to be like “eh, what’s a $5 mascara?” because for the stuff you’re paying for each week wedding-related, $5 is like a rounding error. For me it’s definitely time to separate the personal finances from the wedding finances, since they’re on different scales!

Thanks for this post, I needed a kick in the rear.

Don’t beat yourself up, lady! I’d say what you’re feeling here is mostly that you don’t have control over your spending – and it really ramps up in the last few weeks before the big day – but the amount you’ve actually spent yourselves is seriously not that much! $3K? You go, girl.

Things will calm down soon and then your new paycheques will help you save again. 🙂

Congratulations Daisy for getting married… Marriage is a different experience and completely changes course of life. It’s heartening to hear that you are planning to get a post wedding detox on financial matters. Congratulations again as most people don’t bother to do that and get into more financial burden even if not debt. However, as a married person I can’t help but give a few suggestions to the newly married couple. No matter how many days you have lived in with the person of your love, marriage is a different thing altogether. Though I don’t want to ruin your honeymoon phase of your life but do get some of the facts correct as you are married now. Marriage is a life long commitment (at least that’s what it’s meant to be) so don’t forget to check some of the things correct. Review health insurance policies first. Believe me I’ve saved loads of money by including my wife’s name in the plan I have. It’s prudent to add your spouse’s name as the beneficiary of your life insurance policies, bonds, or even retirement accounts. Have you decided whether you want to file tax jointly or separately? It will be prudent if you consult a financial adviser on this. That’s very important, believe me.

Well it does sound like you’ve done very well with your wedding expenses but you know yourself well enough to know if you are not doing well in the other spending categories. Something you can focus on when you get back from your wedding. Take a deep breathe and enjoy and don’t worry about the wedding now.

Just one more week, you’ll make it through then all you’ll have to do is write thank you cards. I’m sure that sounds easy compared to everything else you’ve been planning.

Daisy, first of all, I would like to say congratulations to you and your partner. Although dreaming for a perfect wedding is very easy, it is quite difficult to make it true without breaking the bank. However, once you have determined the essential things and details you should spend your resources on, you will have lesser chances of overspending.

Congratulations in advance for your wedding. Wedding is really an expensive thing to do you can spend more than your budget. But the important thing in marriage is not the expensive or cheap wedding you have, its both of you end up together and build a family. I can feel the pressure of a woman when their wedding is coming a lot of stress and mix emotions.

Congrats on your wedding! Don’t beat yourself up over what you have spent. If it is gone, it is water under the bridge. BUT… do realize that you have a whole life ahead of you together. The last thing you want to do is start that time together at the bottom of a debt pit. Sorry if that sounds harsh, but I think a LOT of people today are missing the point of a wedding. It is supposed to be a celebration of two people coming together. A year from now, your wedding will be a fleeting memory for the people you invite. If you go on a spending spree, it will be an expensive burden to you for years. Anyway, I wish you both a lifetime of happiness together!

Daisy,

I’ve been furiously scouring through all your posts! I’m a budget-fiend and recently engaged. I also live in BC and I haven’t seen any way to have a wedding in Vancouver for less than 20K! Id love to see a breakdown of the costs! From what I am seeing, food alone for our 80 guests will be $8k. Add the venue ($3k), and I’m already at your budget, without dress, music, photography, hair and makeup and everything else! Would you mind sharing how you kept it down to $11k? My friends all laughed at me when I told them I wanted to have a $7k max wedding. Apparently that’s just our drinks budget!