There’s also another reliable way to pay for it — hit up your parents.

The average cost for an in-state public college for the 2015-16 academic year averaged $24,061, and was $47,831 at private colleges, according to a survey by College Data.

Graduates may eventually cover those expenses with future earnings, but that’s years after leaving college and doesn’t help at all before starting school.

For parents who are generous enough to pay for some or all of their children’s college education, it can require some sacrifices. And I’m not just talking about taking out a loan, dipping into a retirement account or taking out some equity in your home.

Cutting vices

Some families have to make life changes to be able to afford college. These can go well beyond stopping smoking or not going out for coffee every weekday. Getting rid of your vices makes sense for more than monetary reasons, but some pleasures in life are worth keeping, even if your kid has to get a college loan or two.

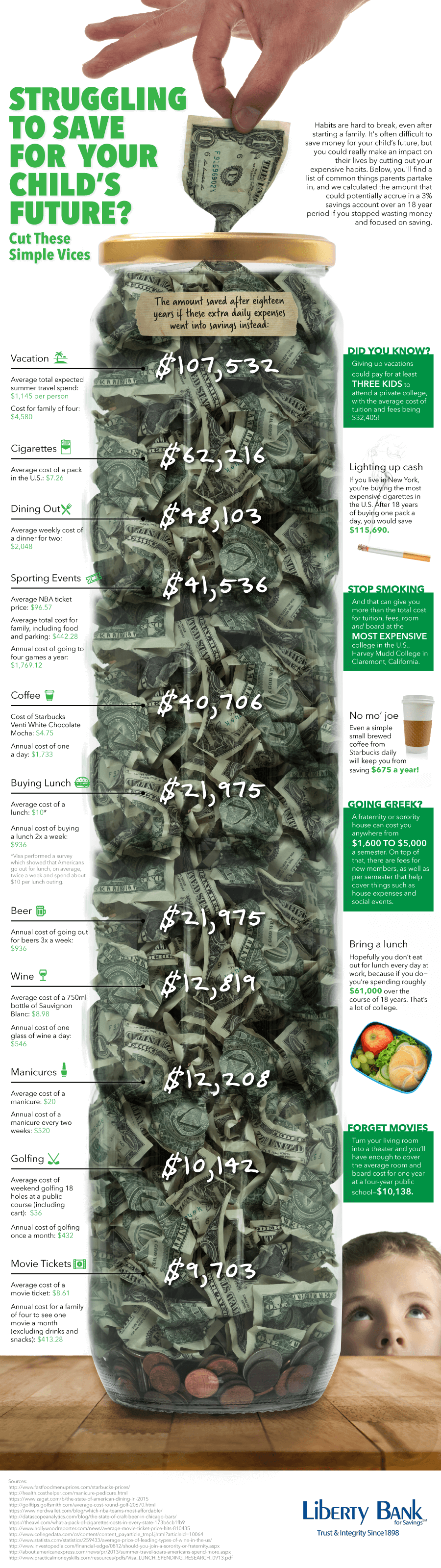

Liberty Bank of Chicago recently put together a graphic (at the bottom of this post) that lists simple vices that can be cut to help struggling families save for college. The bank based the total savings amount for each item on putting the money in a savings account for 18 years that earned 3 percent interest.

It’s interesting to see how much can be saved by not doing something for 18 years — all of your child’s life.

Cutting some vices sound like smart moves — stopping smoking can save $115,000 in New York, where cigarettes are expensive, but $62,000 elsewhere. But other cutbacks could leave you with little to do in your spare time.

No more vacations, beer or ballgames

Here are the top activities it suggests cutting, from the most money saved to the least:

- Vacation

- Cigarettes

- Dining out

- Sporting events

- Coffee

- Buying lunch

- Beer

- Wine

- Manicures

- Golfing

- Movie tickets

Not paying for annual vacations for 18 years could be enough savings to pay for two kids to attend private college. For one year.

After that, you’d have to give up dining out for dinner, Starbucks, not taking the family to any sporting events to pay for three more years of private school for one of your kids.

For the other kid, your family would need to stop buying lunch out, drinking beer and wine, and not having manicures.

That would leave your family with money to spend on such joys as golfing and going out to the movies. That doesn’t sound like too much fun.

If you only have one child or your kids are OK going to a public college, then your costs would drop in half. That would give your family a few more “vices” to pick up again, such as drinking beer and wine and going to a few baseball games a year.

The ultimate lesson here? Maybe going to a private college isn’t such a great idea. Or if they are, find other ways to pay for it such as by working an extra job or taking out a loan so that some of the daily joys in life don’t have to be taken away.

If those aren’t aren’t viable, tell your child to do well in math or sports so they can get some sort of scholarship.

Some vices like eating out and traveling are really crucial for work-life balance. A lot of motivation to work can be found in the drive to eat well and see the world. Your best bet is to select those pleasurable vices that you truly believe are luxuries that you can do without. It’s also worthwhile to invest in yourself by taking away vices that do harm (like tobacco). Thanks for the post and infographic.

The struggle is real. There are lots of influences that can keep us from saving, and I think budgeting and sticking to it are just as important as saving for the education of our own kids.