5 Easy Steps to Eliminating Personal Debt

And that’s probably the first real piece of advice for eliminating personal debt. It is a long road. And if it is a carefully thought out road, it can still be an enjoyable, stress-free one.

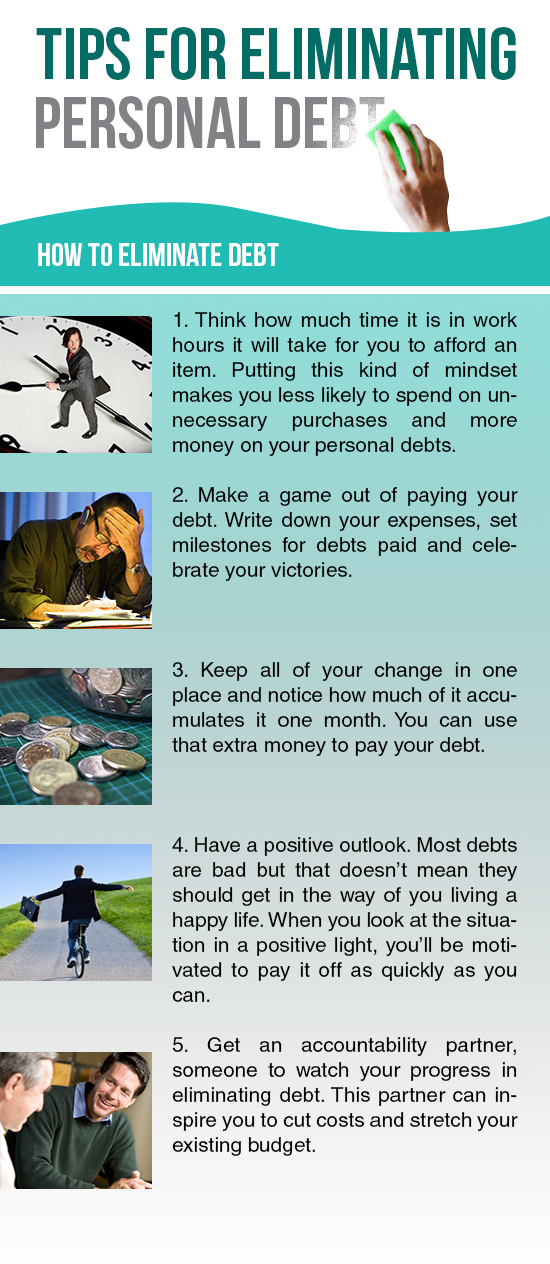

For a lot of folks, they’ve been carrying debt longer than any relationships in their lives; even longer than spouses or kids. So break out of the mind-set of living in a hamster wheel, and start doing something positive to begin breaking it down. Here are five steps to eliminating debt:

Think in Time

Whenever you’re about to lay down $10 on your third XXL skinny latte for the day (or any expense that’s border lining on indulgent), ask yourself – how much time will it take to earn this back? And don’t just quantify your purchases by your hourly wage, hold them up to what you make after taxes. If you’re honest with yourself, you will likely spend less on frivolous, excessive purchases.

Another cost to think about when you’re factoring time > money is your daily interest rate. How much interest are you currently paying on all of your debt? Divide it by days in the month and consider it, too, when you plan to purchase something you may not really need that much.

Gamify your Personal Debt

Track your expenses and pay attention to victories, no matter large or small. Give a small percentage of the debt you’ve been able to pay off back to yourself.

Cut the Right Corners

Whenever you receive money or break a larger bill at the store, take that change and save it up monthly to put toward your debt. You’d be surprised how much you can put toward rent without every really noticing it was missing.

Be Tomorrow You, Today

Mind-set is 99.99% of getting through debt – and a good outlook that’s framed by the realization that debt isn’t a physical constraint, but a mental one can go a long way.

When you’re carrying a burden in your mind, it’s easier to see life as half-glass-empty. Whereas if your outlook were more positive, you may be more likely to see opportunities as they present themselves and be open to change.

It’s easier to manage risk and reward when you’ve got a clear head, so put a plan in place for those bad credit personal loans you’re paying off and then forget about it. Paying your debt down can be automatic while you get on with your life.

Find a Partner (or a competitor!)

Fans of CBS’ popular Dexter series will know that every serial killer loves a little competition to keep things interesting. Well, in this debt-slasher epic – you’ll probably have more motivation to cut costs and stay on task if you have someone around who’s doing the same thing.

Having someone to talk to along your debt-killing spree will also inspire you to get creative and try new ways to cut costs and stretch your existing budget.

Look at your debt for what it is; real life Tetris, nothing more. It needn’t rob you of life’s joys, and it certainly need not weigh you down. Consolidate, plan, and move on!

Whenever I feel myself going off track on my debt free journey, I will stop and take some time to imagine my life without debt and the awesome things I would be able to do, including building wealth.