Parenting ‘Fails’ to Teach Kids About Money

Speeding, swearing, not exercising and poor money habits are bad examples that parents can set without realizing it.

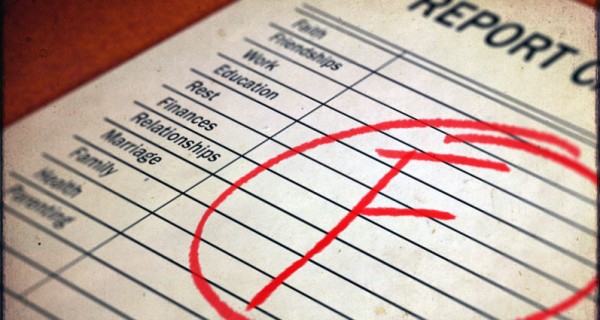

Some parenting “fails” teach children about money — but in bad way. Here are some parenting “fails” that parents can turn around to teach their children about money:

Bad parenting impulse buys

Some impulse purchases can be fun. An ice cream treat after a tough week at school or a movie out as a way to break up the monotony of staying home too many nights can be worthwhile motivators for kids to do better in school or at least be a fun break.

But if you can’t afford them, or spend too much on an expensive impulse buy — such as the latest technological gadget that you’ve coveted for months — then it can show a lack of restraint in how you shop.

Even small impulse buys, if made often, can show your child that it’s OK to buy something without giving it much thought and that you get what you want. But small purchases add up, and a better lesson would be to give up such purchases and put that money aside in a vacation fund for the whole family to enjoy the benefits of giving up short-term joys for long-term planning of a family vacation.

Every parent has probably had their child ask for a candy bar or something while waiting at the grocery checkout line. Telling them no can be difficult, but it beats raising a child who thinks they’re entitled to everything they see.

Not letting them work for their money

Giving a kid an allowance is a great idea — if they work for it. Like indulging impulse buys, handing a kid some cash each week without doing anything in return for it can lead them to equate you with being a bank.

Money doesn’t just appear in your pocket magically. You work for it. And so should they, up to a degree.

Parents provide clothing, shelter, food and other necessities through age 18, and even them some of them are funded less than others as children age. What teen wants their parents picking out their clothes for them at the store?

Be earning money with chores or at a part-time job, kids can learn the value of a dollar and can find out first-hand how many hours of work it takes to afford that pricey pair of pants they want.

Not setting up a bank account for them

If your kids don’t have a savings account or college savings account by age 5, you’re doing them a disservice. Heck, if you don’t have a savings account or retirement account, you’re doing yourself a disservice and teaching them the poor habit of not saving for the future.

Birthday money and part of an allowance can be put into a child’s savings account. Regular trips to the bank to make those deposits can show them how banks work and why they should save.

As children become teenagers, parents can help teach them about managing money by helping them get an ATM debit card, checking account and possibly a credit card with a low limit.

Not following a budget

Just like the first tip on curbing impulse spending, a parent’s money habits can filter down to their children.

If you and your spouse don’t have regular talks in front of your children, or at least within earshot of them, then you’re doing them a disservice by not talking about how you make money decisions together.

You don’t have to detail every expense in your budget, but they should have a general sense of what you’re budgeting for and why.

If you pay your bills late and constantly complain about how you can’t afford the gas bill each month, you’re setting a poor example of how to deal with basic bills. Show them how you budget for that bill each month and where cuts may have to be made to accommodate for it.

Of all of the parenting “fails” to be made with money, try not to get yourself too down about them. They’re learning opportunities at any age, and even learning them when you have children gives you a chance to correct them and let the next generation learn from your mistakes.